Today I wanna show a list of the BEST market sizing case interview examples around the web.

I wanted this best-of list to be at least 5 or 6 items long, but that simply wasn’t possible.

I watched all of the videos available out there to write this. As it turns out, most of them are either misleading or just a waste of time.

This called for a change of plans.

I couldn’t allow this to be a garbage list of half-assed resources.

I decided to record a few videos that are exactly what the internet was lacking.

In them, I’ll show you beginner-level and intermediate-level market sizing examples and teach you (1) what market sizings are, (2) what top performance looks like, and (3) how to solve them.

The list I'm going to give you has...

The #1 videos to understand what to expect in a market sizing case interview and what top performance looks like

The ONLY two other market sizing case interview example videos really worth watching.

My comments on what you should learn from them.

Two bonus market sizing cases you can use for solo practice, which I created specifically for this article

If you don’t know much about market sizings and are looking to understand what to expect in a market sizing case, you’re in the right place. Follow on.

But if you already know what a market sizing is, have done a few of them, and are looking to step up your game, then you’re not in the right place.

You should be taking our free course on market sizings instead.

Here’s the deal. Inside, you’ll find…

- A foolproof step-by-step process to solve any market sizing, guesstimate, or estimation case.

- 3 videos designed specifically for high-quality solo practice.

- In-depth answers within each one so you can compare and learn from your mistakes.

- A comprehensive lesson after each video, explicitly showing the most important takewaywas from the exercise you just did.

By the way, this course is actually designed for case interview fundamentals in general, and Market Sizings/Estimations are one of them.

So Module 2 is where you’ll find all about estimations and market sizings.

This is really the deal of a lifetime when it comes to learning market sizings.

But anyway, let’s dive right into the examples.

Table of contents:

PART 1: The two cases I made to make this list worth reading

– US Brake Pads Market Sizing [Best for beginners]

– Number of neurosurgeons in the world [Hard case, top performance example]

Part 2: The only two other videos worth your time

– US Breakfast Market Sizing [Good practice for beginners]

– US Cheese Market Sizing [Super easy case]

PART 3: Extra practice (in slide format)

– US Online Dating Market Sizing

Part 4: Market Sizings 101

– What is a market sizing case study?

– How do you solve market sizing problems?

– How long should a market sizing take?

– What are the 5 essential steps for estimating a market size?

#1. US Brake Pads Market Sizing

Can you estimate the market size for brake pads in the US?

- Only brake pads used for replacement (now put in new cars).

- Only for personal use vehicles.

TAKE-AWAYS

- This case would be on the easy side of the spectrum but still realistic for a Bain or BCG first round.

- Notice how Bruno can discuss each assumption in depth because they’re discussed in isolation, after the structure has been laid out.

- In this case you’ll see me ask Bruno a follow-up question. Contrary to popular belief, this is standard practice in estimations in MBB interviews. Most examples out there don’t show this, so I wanted to make sure you’re not caught off guard.

#2. Number of neurosurgeons in the world

Intermediate

Can you estimate how many active neurosurgeons there are in the world today?

TAKE-AWAYS

- This case is of realistic difficulty for a first round in BCG or Bain. (To see a final-round level market sizing case go to our free course on estimations and case interview fundamentals.) You should NOT expect something easier than this.

- Notice how the candidate presents two different approaches before starting to solve the case. This is a state-of-the-art technique, and you should absolutely follow this if you can.

- You don’t need to think as you speak like Bruno does. That’s something you should only do if you’re advanced. The interviewer will always allow you a couple of minutes of thinking, especially in first rounds.

Part 2: The only two other videos worth your time

#3. US Breakfast Market Sizing

Your client is a quick service restaurant that’s currently focused on their foot-long sandwich.

They’re considering entering the breakfast market, and they would like your help estimating the market size for breakfast in the US.

- 25% of americans eat breakfast daily.

- 30% of those eat at home.

- Of the 70% that eat out, 50% buy breakfast on their way to work and 20% bring it from home.

TAKE-AWAYS

- Cases from McKinsey, Bain and BCG first round will be harder than this.

- Notice how it’s easier to follow the candidate’s logic when they present their approach and structure before choosing asumptions or doing any kind of calculation.

- The candidate did a great job performing a reality check by the end of the estimation. That’s a habit you absolutely MUST develop before your first interviews.

#4. US Cheese Market Sizing

TAKE-AWAYS

- The assumptions chosen by this candidate were overall shallow. A real interview might require more logic behind them (especially price of pound of cheese and ammount consumed per week).

- Segmenting the consumers into tiers is a great habit, and it’s common for candidates to overcomplicate when they do that (with several different assumptions for each segment). This candidate kept it simple, and you should follow his lead.

- Notice that in this example, the candidate is also asked to reality check their answer. Although many market sizing example videos don’t show this, reality checks are a crucial element in this kind of interview.

Additional Resources: Market Sizing questions are just one type of case interview question… Check out this article to see a complete list of all 26 types of consulting interview questions that you might face at Mckinsey, BCG, Bain, etc.

Part 3: Extra practice (in slide format)

When I first wrote this article I hadn’t recorded the two estimation videos to make up for the internet’s lack of good content.

So to compensate for the lack of content, I made two slide-based drills, designed specifically for solo practice.

So now I decided to leave them here in case you want some extra practice.

Part 3 will have two market sizing cases in slide format that’ll allow you to practice harder estimation cases by yourself and compare your answer to high-quality ones.

What you will NOT find here is the interaction between candidate and interviewer. My assumption is that you’ve already gotten that from the previous videos.

What you're gonna find...

– Case question

– Clarifying questions

– Structure

– Assumptions and calculations

– Reality check

...and how to use it

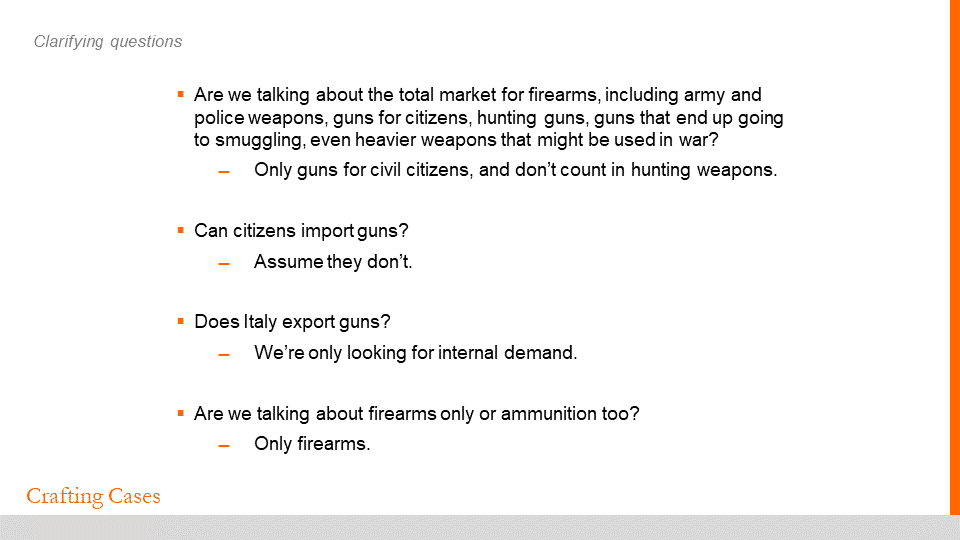

1st – Read the case question and think of questions you’d need to ask to clarify the scope of the estimation, the objective, and the dynamics of that market.

You might not even need to ask any questions. That’s fine.

2nd – Move on to the next slide and look at the questions I would ask.

If there are any issues in there that you would have assumed but not explicitly communicated OR that didn’t even cross your mind, pay attention to that. It would have been a miss in a real case.

3rd – Design the path you would take to get to the answer. No values, just which drivers you would use.

When you compare your structure to mine, look for the drivers I mentioned that you didn’t think of. Those are a lot more important than format.

4th – Choose values for your assumptions and run your calculations to get to the final answer.

Don’t worry about your values being similar to mine. I’m not even sure mine are right.

DO worry about your assumptions being strongly backed up by some kind of data and logic.

5th – Before you move on to the 5th slide, think of at least one way to reality check your answer.

Find something to compare it that would tell you if you were orders of magnitude away from the right answer.

You wanna make sure that you’re not saying, for example, that 1/3 of the US population is made up by cab drivers, or that the shoe market represents 10% of the Chinese GDP.

By doing that, you’re showing your interviewer that you care about the quality of your numbers and that they won’t have to stay up at night reviewing your model if they ever manage you in a project.

Now it’s time to get to work.

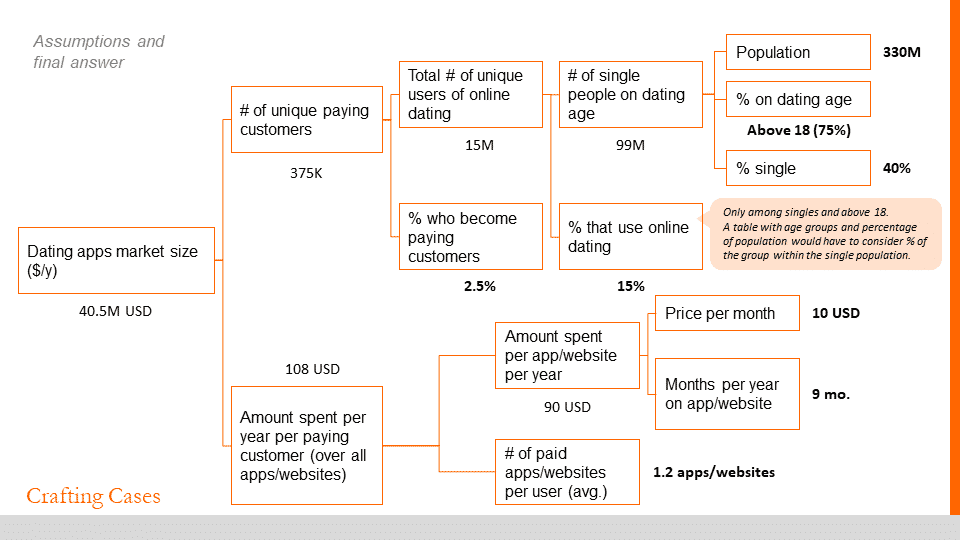

#5. US Online Dating Market Sizing

TAKE-AWAYS

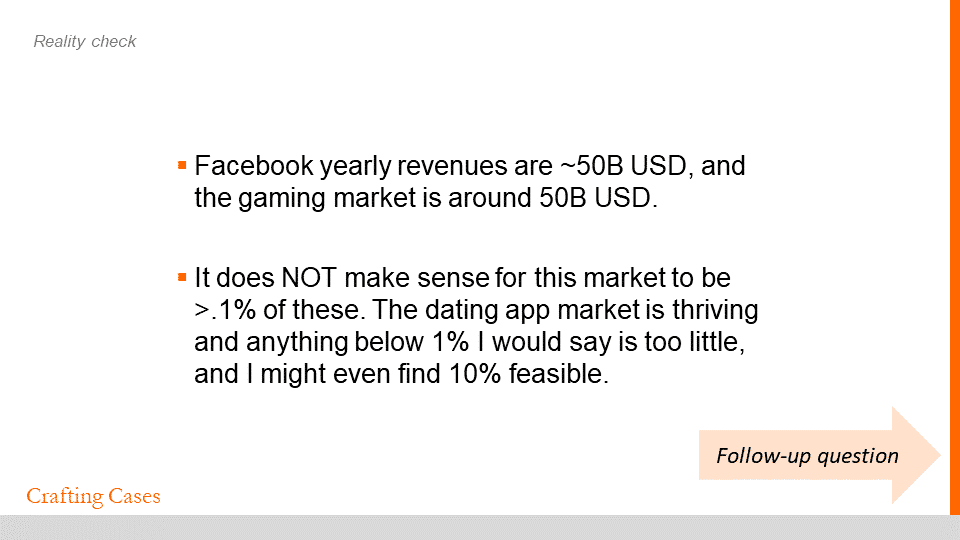

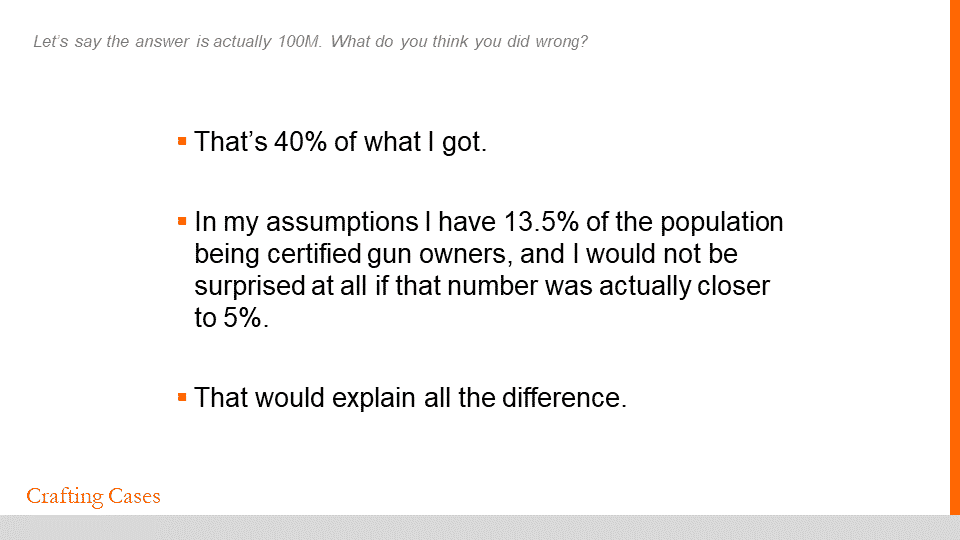

- The reality check on slide 5 caught the big mistake in the final answer. Two traits make this a great reality check: (a) it compares the final result to outside values; (b) the candidate states how much he would find feasible in comparison to the outside value.

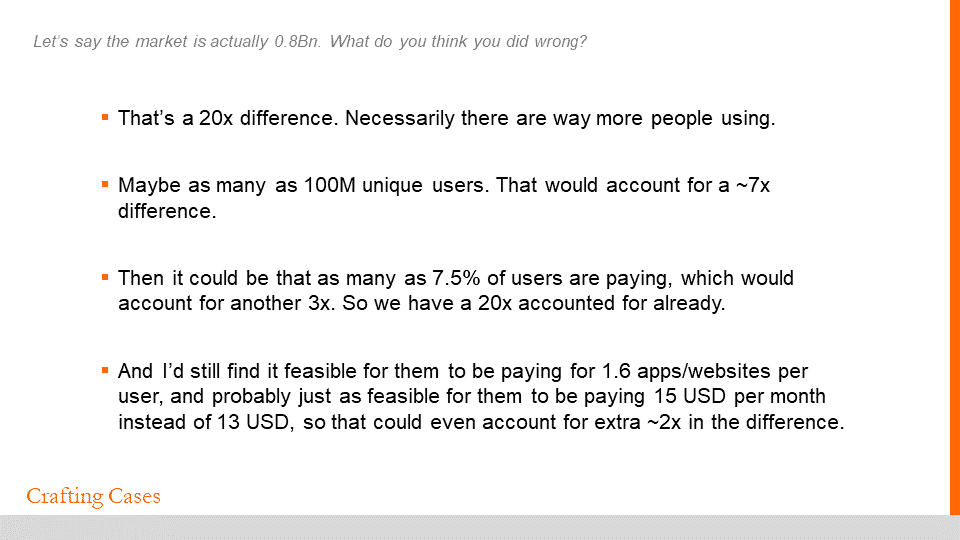

- The second follow-up question is a common one in market sizings, even if your answer is correct. The interviewer wants to check if you can find to which variables the final result is more sensitive, and which assumptions are less trustworthy.

Just a quick note to highlight the value of a well-done reality check: the real market size is actually over US$2B.

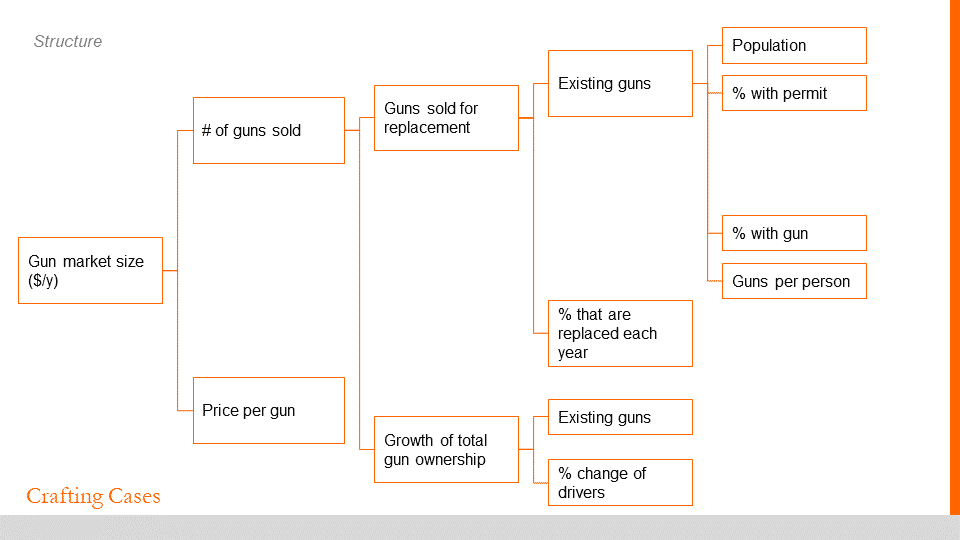

#6. Gun Market in Italy

TAKE-AWAYS

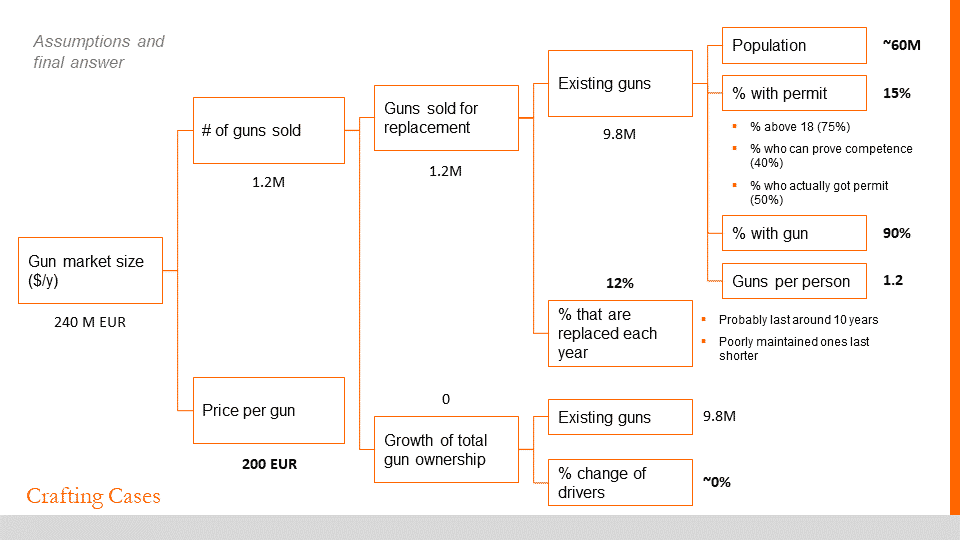

- This case is a great example of when clarifying questions are great to tighten the scope of the estimation AND to show business sense. If the candidate tried estimated all of these markets, he’d likely get lost. If he had just ignored them, in the best case scenario he’d lose the chance to impress his interviewer. Worst case scenario, the interviewer would mark him down for forgetting that there are several other potentially relevant markets.

- The purchase of objects to replace old ones is a main driver in the gun market, as well as in many other durable goods markets.

- Since guns are replaced every 8 years (candidate’s assumption), the replacement rate should multiply the total existing guns from 8 years ago, not current total existing guns. The interviewer might have challenged the candidate on this part of the structure to see if he’d catch that mistake by himself.

- In some situations, the growth of total existing items might be more relevant to total sales than replacement of old ones. Think, for example, refrigerators, in a country where many people suddenly emerge from poverty, or where there’s a sudden increase in available credit.

Part 4: Market Sizings 101

Just to make sure we’re int he same page when it comes to market sizings, I here’s a quick FAQ. If you have any practical question left, chances are it’s answered in here.

What is a market sizing case study?

Market sizings are a type of case interviews where you’re asked to estimate something (generally the size of a market – duh -, but not always), to assess your thinking process and your structuring skills.

Despite what most people think, interviewers are hardly concerned with how close your answer is to the real number.

Often, they don’t even know the right answer. What they really want to see if you develop and present a complex model, choose assumptions with in-depth logic behind them, and plausibly check your answer versus reality.

The idea behind this type of case is that, while estimating an unknown number, you must use most of the problem-solving skills you will need in a consulting (or business analyst) job.

How do you solve market sizing problems?

If you follow these 3 tricks, you’ll successfully solve any market sizing question thrown your way. They are…

- Trick #1: Separate structuring from assumptions from calculations

- Trick #2: Use top-down Structures

- Trick #3: Provide at least two approaches to your interviewer

Trick #1: Separate structuring from assumptions from calculations

A market sizing interview is designed to be outside of your “intuitive” range, and require methodical problem-solving techniques.

You will NOT be able to wing your way through MBB market sizing interviews, regardless of what oversimplified examples out there make you think.

Trust me, overly simple examples are fooling you for the clicks. Real interviews will show you this – the hard way.

When solving any estimation case, make sure you follow the lead of the videos in this article and build out your entire structure before choosing assumptions.

Then, choose your assumptions, one at a time, with in-depth discussions, without starting to calculate.

Only then, move on to running all of the calculations.

That way, you’ll show your interviewer that you…

- Can present your models in a client friendly way.

- Can discuss your model and assumptions before using them (which saves time and money in the real consulting job).

- Can discuss every single issue in-depth, making your models more accurate and comprehensive.

Trick #2: Use top-down Structures

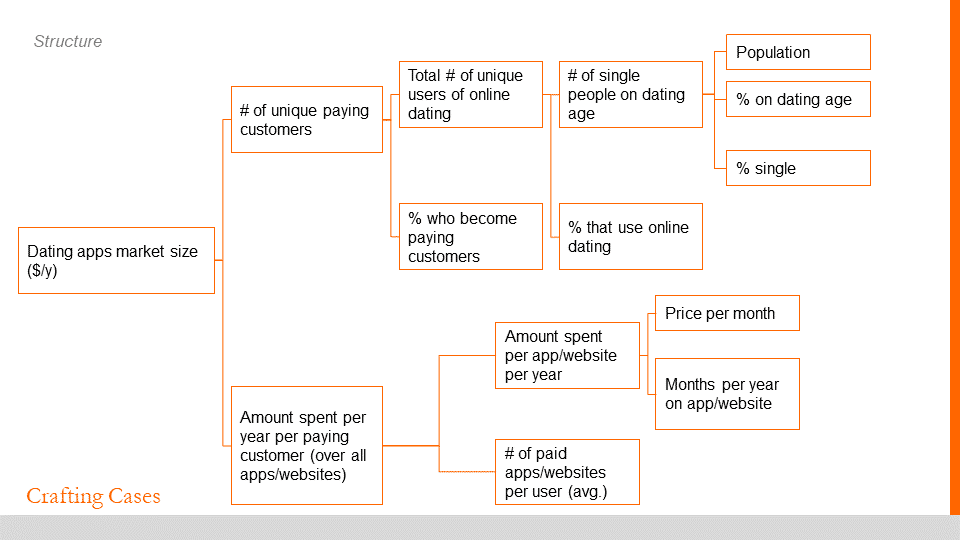

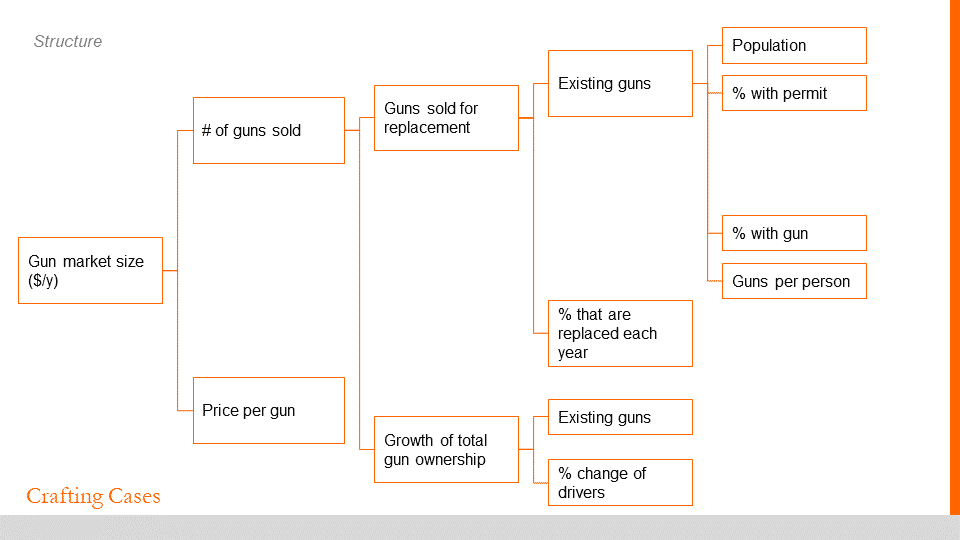

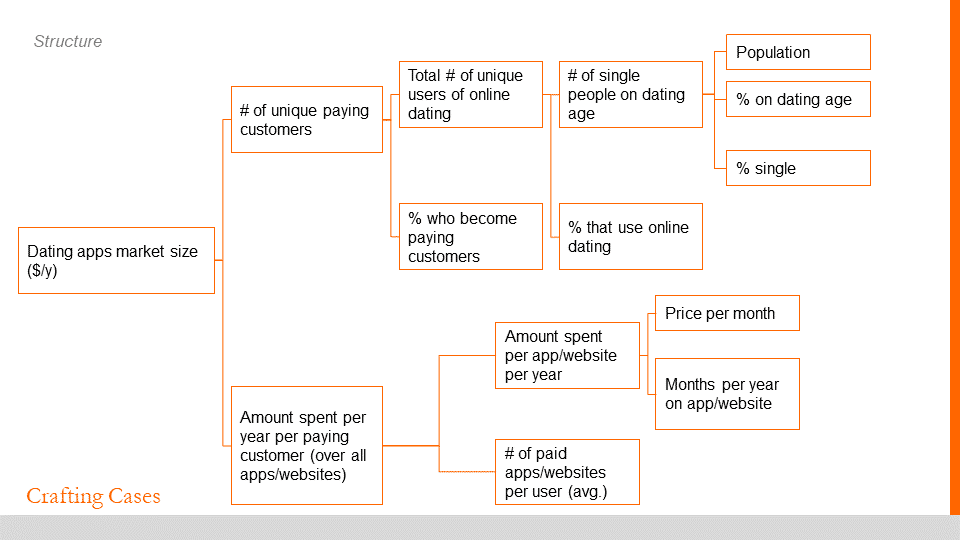

Using top-down structures means creatign a tree-like structure, with arithmetic relationships between the branches, that starts with the number you want to estimate.

Just like the ones in the videos and slides in this article.

Here, check out this example from the US Online Dating Market Sizing above.

Notice how the tree starts in the objective and branches out, through arithmetic relationships, into the assumptions you will need to use.

Top-down structures like this one help you show your interviewer, from the moment you start the case, that you will be able to finish it.

From that moment on, you’ve made a killer first impression, and any bumps along the way will be minor.

Top-down structures also allow you to present your path in a more organized way to an interviewer, which in turn presents you as a good consultant, who can communicate complex problems to clients in a simple way.

Trick #3: Provide at least two approaches to your interviewer

If you go back to Example #2, you’ll see the candidate presenting two different approaches to the interviewer before starting to solve the case.

This has two huge effects on his performance.

First, there are great chances at least one of the paths will work, so there are little to no chances of getting stuck in the middle of this case.

Second, it virtually rules out to the interviewer the scenario that you only solved this case because you were lucky to get a case you just knew how to solve.

If you know how to solve this one two ways, you’re likely to be able to solve others in at least one way, right?

Now, I know none of these is easy to do.

After all, if it were so easy, market sizings wouldn’t be consulting interview questions in the first place.

You’ll need some practice if you want to use these tricks consistently.

To get this practice right now for free, join our free course on market sizings and other case interview fundamentals.

In Module 2 of the course, you’ll get an in-depth presentation of the 5 steps to solve any market sizing case as well as 3 high-quality drills, designed specifically for solo-practice.

How long should a market sizing take?

A market sizing interview can take anywhere from 15 to 30 minutes.

However, if the estimation is simple and just a part of a larger case, it might take no more than 5 minutes.

As the estimation gets more complex, it might represent more of the case (as it can now test more skills) and can go up to taking the full case. Just like in the two examples in Part 1 of this article.

What are the 5 steps for estimating a market size?

There are 5 steps to properly solving any market sizing or estimation case: choosing an approach, structuring, choosing assumptions, calculating, and reality checking.

You can learn how to perform each one of them and get some high-quality practice in our free market sizing, estimation, and other case interview fundamentals FREE course, by clicking here.

How do you structure a market sizing case?

To structure a market sizing case you must break down the number into two drivers with a mathematical relationship between them.

Then, repeat that several times, building a algebraic tree, until you get to assumptions you can reasonably guess.

For example, you’d start by breaking down the Italian gun market size into number of guns sold times the average price per gun.

Then, you’d break down each one of those variables, and so forth, until you reach the result below.

What's next?

You’ve seen what a case interview is like and you were even able to practice some of the harder ones.

That puts you in fair advantage, given that these cases are scarce to practice, but frequent in McKinsey, BCG and Bain interviews.

Now, I wanna help you pick your next step, with more free, high-quality content.

If you’re still not feeling confident in performing a market sizing case in an actual consulting interview, I’ve got a solution for you.

It’s a a step-by-step approach to tackle any market sizing case out there, plus some in-depth practice material, with realistic market sizing questions and high-quality answers to guide your learning.